| Description |

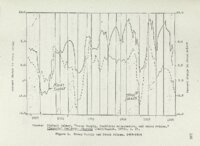

The thesis shows that the penny stock market that traded uranium stocks during the 1954-1957 era was a market unique in itself. It shows that stock market models used for contemporary analysis cannot be applied to the penny market. The inexpensive uranium stocks traded during this era fluctuated wildly but not in response to customary variables. These variables such as profitability, liquidity, and production did not exist. Sources used to gather information for the thesis were mainly Federal and State legal files and personal interviews. There was little material in the libraries on the subject in question. The questionable and illegal nature of some of the acts of the persons interviewed necessitate anonymity. Those interviewed for the data were very much stratified, including brokers, investors, promoters, and corporate officers and legal advisers. There were two main factors contributing to the market's success; one was extreme optimism and the other, the feeling that the individual promoter had inside information. A great deal of money traded hands during this era, but very little found its way to the individual investor. Stock promoters and brokers were in a far superior position to make money. The penny uranium stocks fluctuated because of greed, emotion, expectation, rumor, and half truths; and I could develop no model that could be used with any degree of reliability to predict price movements of these stocks. Most of these stocks did not survive past 1958, but many have been revived as shell corporations in the mid-sixties. The weak securities laws and poor monitoring were largely responsible for their creation and their reappearance. |